Chinese stock indexes CRASH as investor confidence drops due to resurgence of punishing lockdowns

04/27/2022 / By Arsenio Toledo

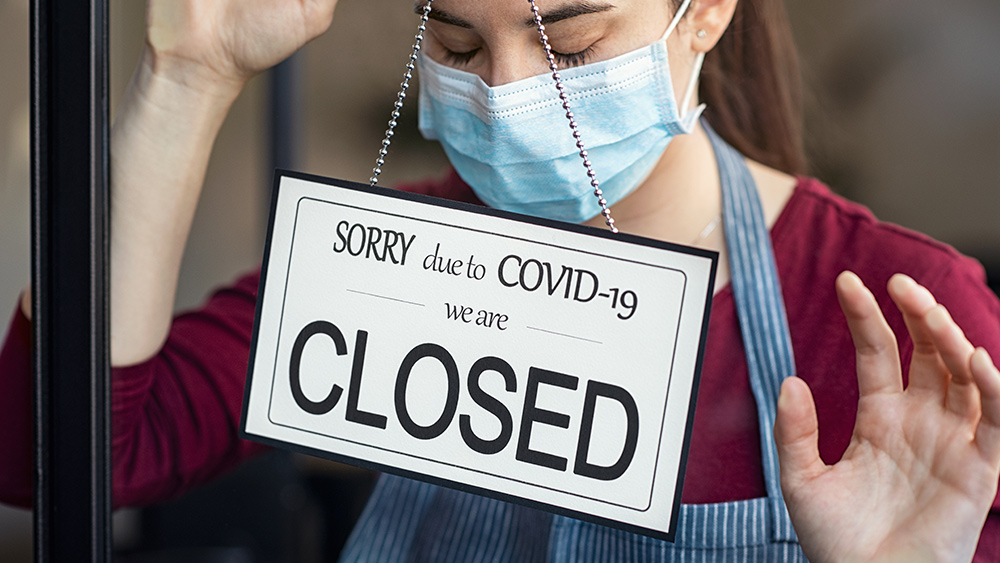

Chinese stock markets plummet as investors become increasingly concerned over the resurgence of Wuhan coronavirus (COVID-19) lockdowns.

The “zero-COVID” strategy imposed upon the entirety of the country by the Chinese Communist Party (CCP) has been a total failure. Not only have cases continued to surge in Shanghai, but more infections are also being detected all over the country, including in the capital of Beijing.

“There are concerns about the COVID situation in Beijing evolving into what happened in Shanghai with some prolonged lockdowns that bite the economy,” said Kevin Li, portfolio manager for Hong Kong-based GF Asset Management Ltd.

Some of China’s largest stock indexes, including in Hong Kong, all fell in value, with the Shanghai Composite Index falling by as much as 5.132 percent to 2,928.

This is the biggest single-day drop in the Shanghai Index’s value since the beginning of the pandemic. The index is now down 20 percent year-to-date and down 14 percent from the same time last year.

The CSI 300 Index, which tracks the largest blue-chip stocks trading in Shanghai and Shenzhen, dropped by 4.9 percent on Monday, April 25. This index is down 23 percent year-to-date and 25 percent year-over-year.

ChiNext, the main index for tech companies in Shenzhen, one of the primary hubs for tech start-ups in China, fell by five percent to 2,181.44.

In Hong Kong, the Hang Seng Index, one of the main indexes where Chinese companies operating in Hong Kong are listed, plunged by 3.7 percent on Monday. The value on the index is down 31 percent year-over-year. The Hang Seng Index has also regressed to a level not seen since January 2007.

The drops in value in China’s stock indexes represent billions of dollars worth of investments that have been sold off.

Chinese stock traders unconvinced by pledges of support from Beijing

Chinese President Xi Jinping is attempting to draw investors back in by offering commitments to boost infrastructure construction. The construction industry has been one of the primary drivers of economic growth in China, and in recent years the property development sector has slowly collapsed, hitting the communist nation’s economic growth hard. (Related: China’s Evergrande indefinitely suspended from trading in Hong Kong Stock Exchange.)

The verbal commitments from Xi and other high-ranking CCP officials have failed to draw significant investor influence.

On Tuesday, April 26, the People’s Bank of China, the country’s central bank, attempted to boost stocks with a plan to support small businesses. But this commitment did not last through the day, and the CSI 300 closed 0.8 percent lower.

The lack of interest in mere words supports the view that the main factor preventing investors from returning to Chinese stock markets is the “zero-COVID” strategy and the extreme economic restrictions that follow it.

“Widening lockdowns across the nation are damaging business confidence and disturbing supply chains, yet top officials have shown no indication of moving away from this stance,” wrote Bloomberg.

“The market is no longer responsive because there’s no easing up of the negative in view right now,” said Yang Ziyi, a fund manager for Shenzhen Sinowise Investment Co. “We just need to wait. We saw the same kind of numbness towards vocal support during the burst of the 2015 bubble and in 2018.”

“A revelation has hit traders that Chinese policymakers are facing an impossible trinity of goals here. They’re not going to hit the 5.5 percent growth target and limit the amount of leverage in their system and also have a zero-COVID tolerance policy,” said Eli Lee, head of investment strategy for the Bank of Singapore. “And this means, at the margin, the thesis for the Chinese renminbi and equities is weaker.”

Learn more about the latest events in China at CommunistChina.news.

Watch this video as financial analyst Gregory Mannarino talks about tanking stocks and the crisis in the economy.

This video is from the What Is Happening channel on Brighteon.com.

More related stories:

China’s shutdown of Shanghai port will ripple across the entire world by summer.

Food scarcity alarm bells ringing in CHINA as farmers face a collapse of fertilizer availability.

First Shanghai, now Beijing: China goes on another lockdown spree.

China’s draconian COVID restrictions are CRIPPLING supply chains worldwide.

Sources include:

Submit a correction >>

Tagged Under:

big government, bubble, chaos, China, coronavirus lockdown, covid-19, debt collapse, economic collapse, economy, finance, financial collapse, infections, medical fascism, Medical Tyranny, outbreak, pandemic, risk, stock indexes, stock market crash

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

MedicalFascism.News is a fact-based public education website published by MedicalFascism News Features, LLC.

All content copyright © 2018 by MedicalFascism News Features, LLC.

Contact Us with Tips or Corrections

All trademarks, registered trademarks and servicemarks mentioned on this site are the property of their respective owners.